Fast Cash Dash Flash Crash Clash

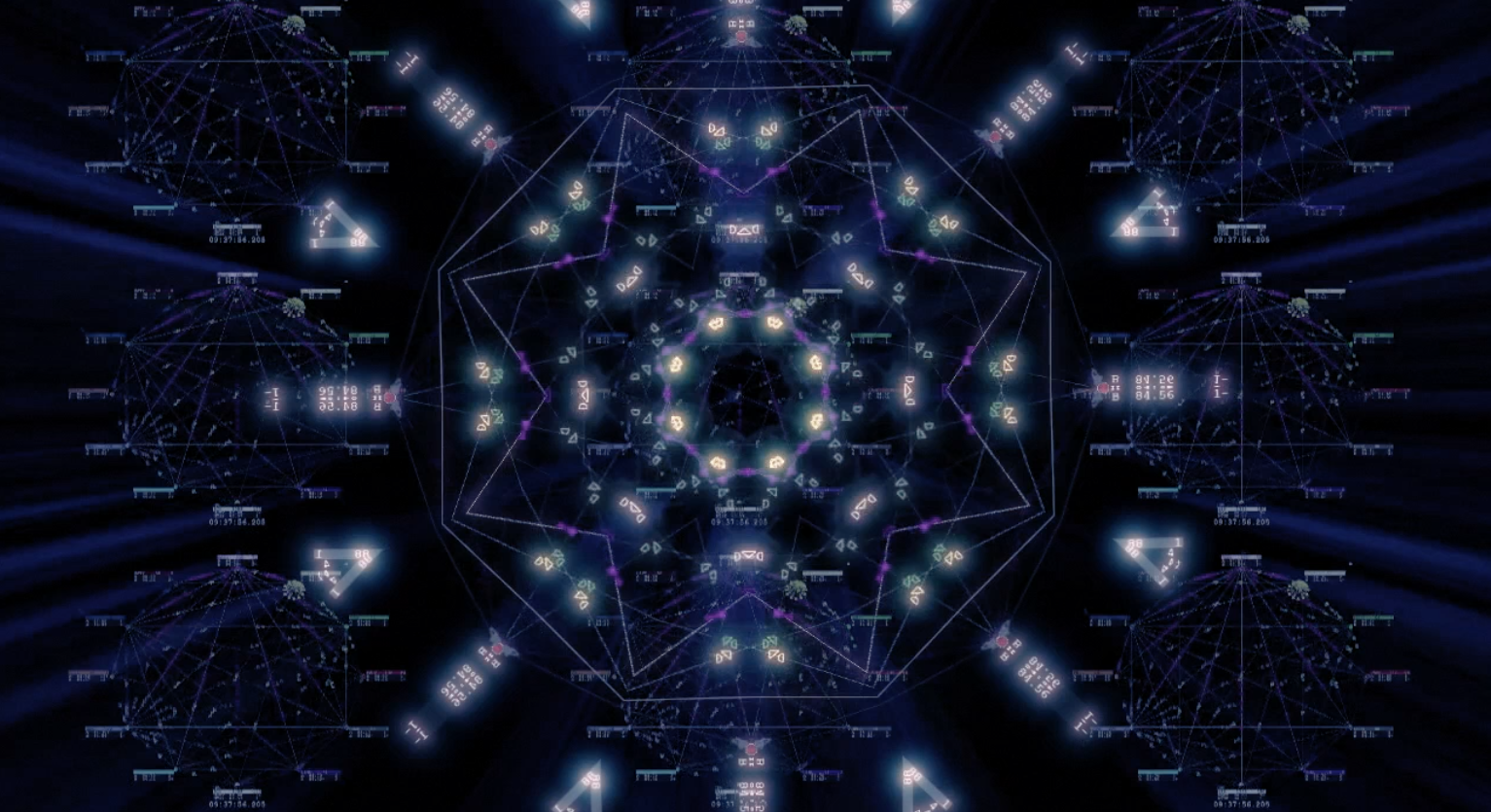

Video based on High Frequency Trading algorithms visually represented as some kind of mandala. We hear a computer voice caught in a loop, or a mantra, citing “Fast Cash Dash Flash Crash Clash.”

In the background we hear server room noise and sporadically HFT algorithm sonifications.

High Frequency Trading (HFT) is a subset of algorithmic trading which works at very low time horizons (100 milliseconds) and requires massive information processing capacities. Following recent developments such as flash crashes and various technical break-downs, it is crucial to unpack the black-box of algorithmic high-frequency trading in order to understand its potential impact on wider social and economic systems.

High Frequency Trades (HFTs) are complex socio-technical systems that thrive both through the production of noise and by the reduction of information gradients, operating at a high rate of throughput and offsetting noise/entropy to the wider financial ecology. In order to explain these claims it is necessary to briefly chart the evolution of computing within finance and the subsequent appearance of algorithmic trading. From carrier pigeons and the transatlantic telegraph cable to contemporary ICT, finance has always been a site for intensive technical innovation. This is no surprise, inasmuch as financial actors thrive by accessing and reducing information gradients and exploiting communication inefficiencies.

Global finance can be seen as the staging ground for a continual redistribution of energy and information gradients; HFT is a prime example of this kind of evolutionary landscape. During the 2010 flash crash, the main US stock index (which is a replica of the market as such) lost about 900 points in a few minutes, recovering most of that loss in the subsequent 15 minutes.To put things into perspective, it represents the wipeout of about $1 trillion in the scope of minutes.